On 6 January, the US-based video streaming service Netflix opened its service up to people in the 130 countries where it was not already present. Before that those wanted to watch in those countries had to go through some contortions in order to watch. For those in India who faced those issues, Netflix India is a boon.

On 6 January, the US-based video streaming service Netflix opened its service up to people in the 130 countries where it was not already present. Before that those wanted to watch in those countries had to go through some contortions in order to watch. For those in India who faced those issues, Netflix India is a boon.

This is a huge move that will shake up the way video is watched and distributed around the world. That's because for the first time, a single service is available in nearly every country (bar Syria, Iran and North Korea, because of US laws, and China, for other reasons not covered here). Up to now content has been licensed out territory by territory, to different distributors. By becoming a global presence, Netflix will ask for and very likely get content rights to all territories. Even if Netflix doesn't get exclusive rights, local players will have a hard time competing against Netflix's $5 billion content budget to achieve the same breadth of offering that Netflix will have. Throw in Netflix's increasing list of original and award winning content, and it's technological edge in devices served and user experience, and it's hard to imagine why it wouldn't be successful.

Opportunities

Premium Content

In India especially, Netflix has a great opportunity with premium, imported content. Although there have been other streaming video players in the market for several years, none of them have broken out in terms of success. The reason, if one were to guess, is that they lacked any premium content, by which I mean content that is not broadcast on general entertainment channels or is available only on premium tier channels. It is a vague term. Maybe the best definition is that it is the content that people download from file-sharing sites and bit torrent. In this environment, a certain segment of the population may welcome the access to the international selection of content that Netflix brings.

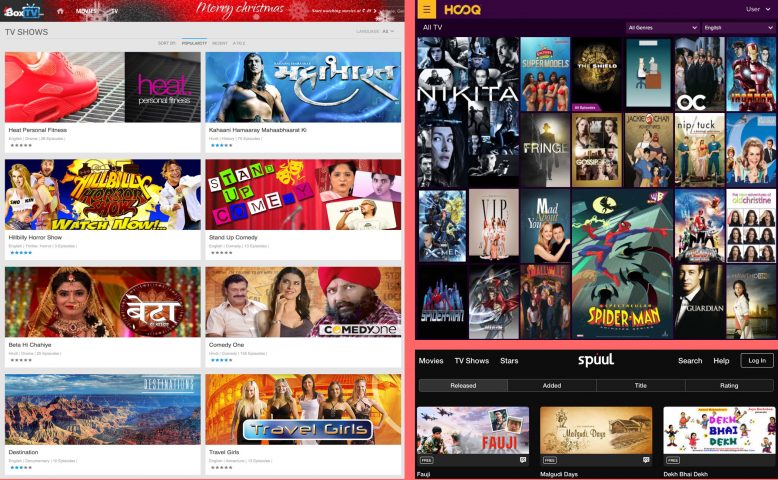

To see how sparse is the offering, compare Netflix's TV shows available in India at the time of its global launch with the number of English shows on Box TV, Spuul and Hooq, three other video services that charge viewers for content.

Netflix: 193

Box TV: 51

Spuul: 1

Hooq: 61

Apart from a handful of titles in the Box TV and Hooq lists, most of the shows on those services never featured in the top 10 shows of any premium or broadcast network in the USA or the UK in the last 5 years.

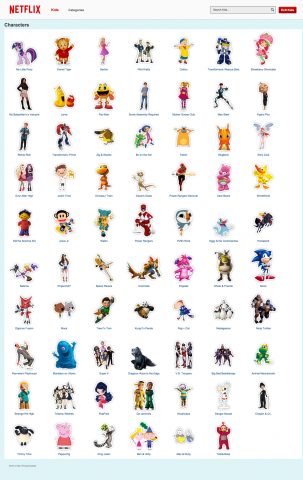

Children's Programming

One of Netflix's other great strengths is its array of children's programming. In India at the time of launch it offered 69 television shows, some of which aired in the US on the PBS Kids network, a brand which lends them the cachet of respectability and education value. Parents who want their children to learn English may find this to be very attractive. Furthermore, young children like to watch the same program over and over again, so even a show with only 24 episodes could keep kids occupied for multiple number of hours. For some parents, that may be reason enough to subscribe.

Challenges

Payment Challenges

The challenges that Netflix faces in India are somewhat unique to the market. To begin with, Netflix requires subscribers to use a credit card. Credit cards as a payment method may be attractive to Netflix because it can use a common payment gateway for many countries without having to build payment infrastructures in each territory. However, only 22 million people in India have credit cards, a number which hasn't changed much in the last 5 years. That means only 22 million people out of the potential 200 million Internet users can even sign up for Netflix.

In order to increase its potential pool of customers, Netflix could integrate with Indian payment systems. However, then it would need to operate as a local player, which means that its credit card payments would also fall under the Reserve Bank of India's rules. Those rules require 2-factor authentication on card-not-present transactions. Currently, once Netflix has a subscribers card details, it automatically bills their card every month. With 2-factor authentication, Netflix would not be able to do so and would need the user to enter a one-time-password (OTP) or some other piece of information, which would make automatic billing impossible. Every time a subscriber is asked to actively make a payment, it presents a potential loss of customer, which Netflix would be keen to avoid.

Censorship on the Horizon

The other issue with becoming a local player is that it would bring Netflix's content under the control of the Indian government. At the moment, as a site outside India, it can distribute content that has explicit nudity, depictions of sexual intercourse and adult language. If it is forced to submit its content to the Censor Board (CBFC), much of it may very likely lose its appeal. There are anecdotal examples of people downloading content from file-sharing sites even though it is broadcast on TV in India in order to get the full version. This presents other kinds of challenges, such as for example the case when the content is not produced by Netflix. Who would make the required changes, Netflix or the original producer, and what if the content rights owners do not agree to such changes? There is also the question of whether the CBFC

State of the Internet

The last challenge for Netflix may be the way the Internet is growing in India. Most people get online via their mobile phones. Not only does that mean a slower and less reliable Internet, but most of those access plans have limits on the amount of data that can be transferred. At a very low bitrate of 300Kbps, which may look okay on a mobile phone screen, an hour of video would use up about 150MB of data. Watching just 30 minutes a day for a month would require a minimum 2GB data plan.

Please like NewsPie's page on Facebook so that you get all our articles and others may find us.

Update: An earlier version listed Iran as a country where Netflix is not available. This has been changed to Crimea.